Power Laws

Let's do a thought experiment.

The year is 1800. You’re a loan officer at a bank. Farmers come to you asking for a loan - maybe to purchase new equipment, buy more land, or make investments to improve their farm’s productivity. What are your criteria for granting a loan?

You’ll primarily want to do 2 things: avoid the losers, and reduce risk. To avoid the losers, you’ll want to learn about a farmer’s reputation and character. Are they honest and hard working? Do they have any major vices that might undermine their productivity? To reduce risk, you’ll assess the value of their collateral. How valuable is the land the bank would repossess in the case of a default?

In short, you’re much more interested in minimizing downside than you are in maximizing upside. Why? Well, giving a loan to an excellent farmer probably isn’t going to make you much more money than giving a loan to a median farmer. If a farmer has an incredible yield and produces 3x more than expected - which is very unlikely - you don’t get paid 3x the interest. Your goal is to maximize the number of loans in your portfolio that don’t default. Most of your loans are given to farmers with fairly consistent profiles - similar plans, business models, skill sets, and characteristics. You’re hoping for a consistent batting average, and you aren’t counting home runs.

Now, let’s jump to the present. Instead of a loan officer, you’re a venture capitalist, investing in early stage startups, hoping to maximize the value of your fund. How does this change your criteria?

As a VC, extreme outcomes drive the return on your fund. Accordingly, you care more about unique advantages and differentiators that give a startup a chance at becoming the winner in its category. Most investments will lose money, and many will go to zero, so the structure of financing needs allows for uncapped success when you pick a winner. You want to bet on startups that, if massively successful, could return the value of your entire fund or more.

The difference is that venture capital is ruled by power laws. Unlike a normal distribution, power laws mean that extreme outcomes drive the average, making the average very different from the median or most common outcome. This is how a VC can make money even though most investments fail—the average is pulled up by outliers.

In a power law world, landing big wins is more important than reducing downside in the median scenario.

Income tax returns follow power laws

The vast majority of the US Government’s revenue are taxes on the earnings of citizens. Human capital is the primary asset of the US Government. And those tax returns follow power laws.

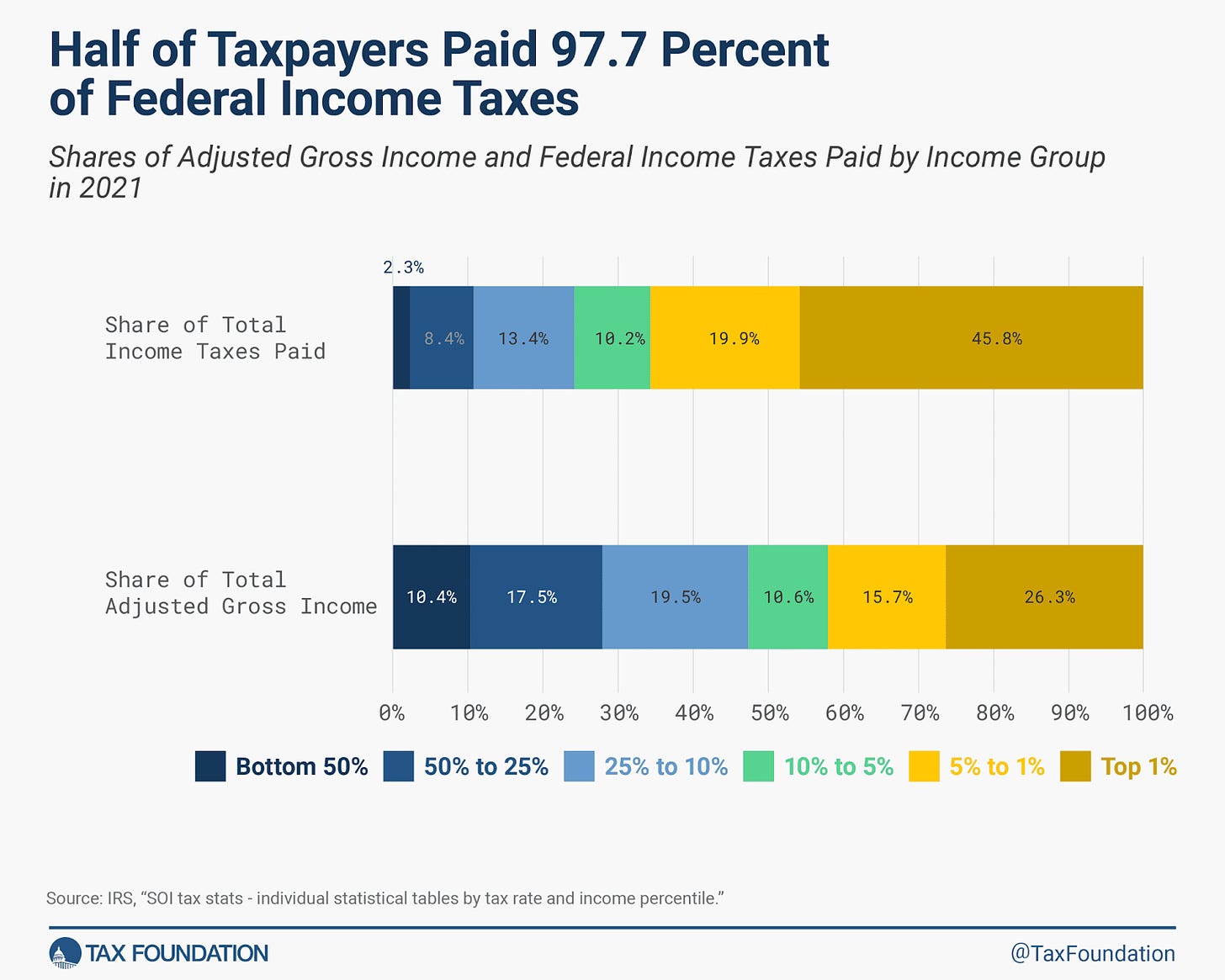

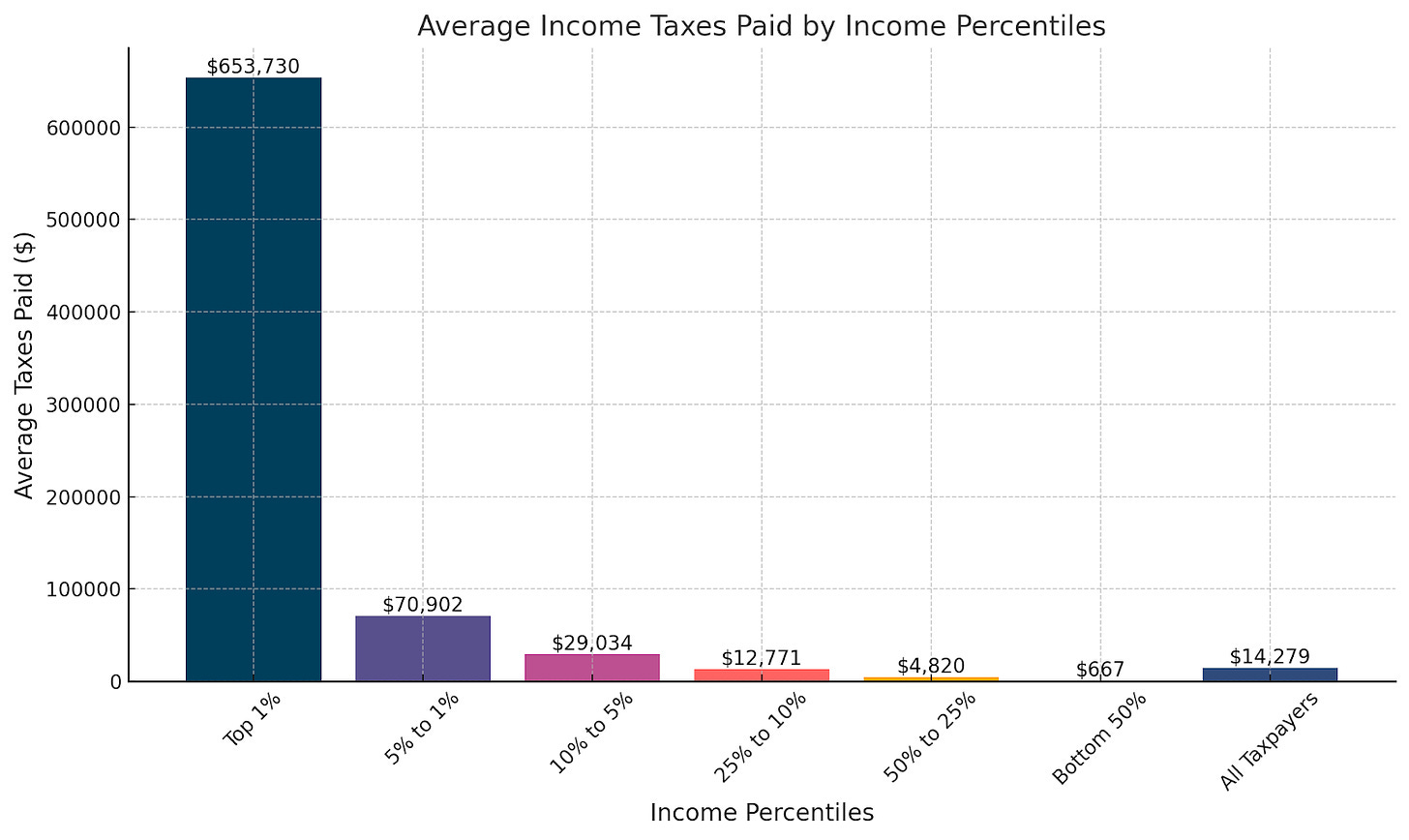

According to the Tax Foundation, the median taxpayer earns about $47,000, and likely pays around $3,300 in federal taxes. The average federal tax paid is $14,279 - over 4x higher than the median. Extreme values at the top pull up the average.

Despite frequent proclamations to the contrary, high earners pay a disproportionately large share of federal income taxes. The top 1% pay close to half of all federal income taxes. The top 10% pay over 75% of all federal income taxes.

This does not mean we need to lower taxes on the wealthy. It suggests that any increased yield from minor improvements at the top are likely to dwarf the potential savings in the bottom or middle. Resources might be better spent helping more Americans become high earners without too much concern for breaking even on the median citizen. Like a VC, we could focus more on increasing the number of home runs and less on a consistent batting average.

Despite this, attitudes across the political spectrum tend to focus more on minimizing downside risks—like the loan officer—rather than optimizing upside potential. On the right, the priority is often to limit spending on social services and encourage self-reliance with minimal government support, essentially cost cutting at the bottom. On the left, public spending aims to "level the playing field" rather than empowering high-potential individuals to maximize their productivity and raise the standard of living for everyone, overlooking the disproportionate gains to be had at the top.

In an agrarian society of the past, the “loss minimization” perspective probably made sense. For instance, would extensive formal education result in 10x returns from a society of pre-industrial farmers? That seems unlikely. It was more practical to focus on helping the median citizen become moderately productive, and prevent too many individuals from becoming burdens to society.

In today’s power law society, it’s more productive to focus on hitting home runs.

Outsized Returns

Another way of thinking about this is to put yourself in the government’s shoes.

Let's say I make you a deal: I’m going to pick a random high school graduate and give you their share of tax revenue, forever.

What would you do to maximize the value of this investment? Would you encourage taking the first minimum wage job available, or spending time learning and exploring to find a career in which they could thrive?

Looking only at federal income taxes, this is how much your investment might return every year depending on which income bucket they fall into.

If you’re unlucky, and you decide not to invest in your graduate, the student might fall into the bottom 50% of earners. Your graduate might make $30,000 a year as a cashier, and you might make $700 a year. If you get this for 40 years, you’ll have collected $28,000 over your graduate career.

If your graduate manages to make it into just above the top 50% - perhaps as a truck driver making $56,000 a year, or a police officer making $76,000 a year - you might make $5000 a year, or $200,000 over 40 years. This is already 7x higher, and neither of these careers requires a college education.

A graduate who makes it into the top 5% might be sending you $65,000 a year.

Here’s a sampling of options, along with what your yearly federal tax return could look like over the course of their career.

But of course, average stats for various careers don’t do justice to the power laws at play, because they don’t capture the chance of your graduate becoming a massive success. If your graduate makes it into the top 1%, on average, they’ll be sending you close to $700,000 dollars every year.

Even distribution within the top 1% is also dominated by power laws - so this average is likely much higher than the median return within the 1% - again suggesting a focus on big wins.

What would a private equity firm do, presented with the same deal, for an entire underperforming school district? Would they optimize for short term self-sufficiency, or invest heavily to produce as many high earners as possible? It’s hard to know exactly how, but I suspect they’d find a way to turn at least some of those kids into home runs.

Focus on Home Runs

What would this look like? Similar to a VC, it could mean focusing more on unique differentiators and prioritizing big wins over median losses.

This might manifest in many different ways across public services.

In public education, we might focus less on proficiency across a standard set of skills and instead cultivate individual superpowers to give students a chance at becoming top performers in specific categories. We might double down on gifted or high-performing students, fully recognizing the benefit they bring to society by realizing their potential.

While there are a wide variety of programs to support the jobless, including limited reskilling and retraining, many of these programs focus on immediate needs and self-sufficiency, and less on helping individuals become positive-ROI in the long term. Instead of encouraging the jobless to accept the first minimum-wage job available, we might enable taking time to learn high-value skills, or starting a business. If even a small percentage of participants become high earners as a result, it could quickly recoup the overall costs of such a program.

Similarly, public discussion about immigration often focuses on perceived costs rather than the potential for tax revenue. High-skilled immigrants, especially those on H1B visas in sectors like tech and healthcare, often earn salaries well over $160,000. Unfortunately, the demand for H-1B visas far exceeds supply, even though each additional immigrant in this category generates substantial positive tax revenue from the outset - enough to offset public spending for multiple individuals in the bottom tax brackets.

We might actively seek out and invest in underutilized talent or underemployed high-potential individuals. We might even allow anyone to apply for an open-ended grant to dramatically increase their own earnings potential, contingent on presenting a feasible plan to do so. Today’s internet makes it possible for anyone with the time and will to learn almost anything at a low cost. A relatively small grant might give someone on minimum wage—making $15,000/year—the free time they need to learn a new skill over six months that could quickly 10x their earning potential. If just a small percentage of recipients make it into high-paying careers, the initial investment would be recouped many times over.

These are just hypothetical examples that may or may not work in practice, but they serve to highlight the lack of policies focused on unlocking major potential gains at the top. While the best interventions might not be immediately obvious, any properly incentivized party would aggressively invest in finding out which ones work, because of the massive upside of any success.

In our power law world, helping a small proportion of the population achieve high-earning potential generates returns that can cover generous benefits for everyone else. Home runs pay for a lot of strikeouts.

Human capital is the US Government’s primary asset, and in today’s day and age, those returns follow power laws. We should start acting like it.

This user just discovered this substack by seeing the sample post on the "Counter_Economics" subreddit whilst visiting it on a mere whim this morning while waiting for something to occur, elsewhere. Was just in the process of replying to it on there, when seeing the substack link and remembering that this user may be shadowbanned from most of reddit (as usual) and their posts are not always seen, but a reply to the substack-proper would likely be seen (probability being analyzed, again).

Here's what this user's response was on the subreddit (regardless of whether it shows up there or not):

Life, at least as/for what passes for a "human being" (regardless of whether said "humanity" is an amalgamation of other races intermixing or not -- "race", of course, not being a "sOcIaL-CoNsTrUcT" as the Left/State want people to believe; the Negroids are originally from the Sirius-B star system, and many Pacific Asians live in huts shaped like their progenitor's starships, for example) is about the measuring of PROBABILITY and depending on one's individual choices, or perhaps mental conditions (autism, thrill-seekers, etc.), making a decision to gamble on probabilities for certain things at certain thresholds.

As AdamBaratta of "Gold Is A Better Way" said on at least one affiliated "Revealed Films" video with Dr. PatrickGentempo, several years ago, humans can't grasp exponential growth (so, for example, the rate of inflation isn't prominent in everyone's minds).

In the OP above, the author says that people would/should avoid risks and minimize collateral and vices, and gauge the content of a would-be receiver of a loan before granting one.

That may be the way for "Homo economicus", but "Homo economicus" is not what this species, or amalgamation of species is, in its entirety, as some people, for example, women and non-Caucasians, are traditionally/usually more empathetic than men, who are more logical, as the Left/State know and prey upon this fact (thus, why the Left/State are comprised of more women and minorities than the libertarian/AnCap sphere-of-influence at-large).

SOME INVESTORS....ARE more interested in (or at least, not always against the idea of) "maximizing upside" than they are in "minimizing downside". In short, many people are gamblers. Life and living life is, itself, a gamble. "Is one going to die after getting up and out of bed in the morning by stepping on a nail or should they stay in-bed with their insecurities?" Some people are paranoid and some people are not. Some people are nihilists and don't care at all, or made-sociopaths or born-psychopaths who "have no yesterdays" (regrets/empathy).

For some investors who are in a bad spot, who are in poverty and sick of it or otherwise are irrational from external or internal stimuli (cancer, oppression by a gang, etc.) will choose to prioritize "chasing the dragon" and "carrot-on-a-stick" and maximize upside, perhaps at the risk of not minimizing the downside. The Left, State (as a construct) and Central Banks themselves are all caused by, and cause in-turn, irrational behavior by and for those with high-time preference, and they all succumb to "The Shirky Principle" in the end (they create problems for themselves and their supposed protectorate/subscriber in order to stay in-business and retain the faith of the protectorate/subscriber in a grand grift).

[Aside: Am not advocating either way, all the time, am just responding with the fact of the matter to an otherwise very well-written OP; if one is in space, in a failing starship, sometimes risks need to be taken, for example, like the "Ebon Hawk" firing on the volatile asteroid field, blowing up "Peragus" to escape the wannabe-"Sith" who commandeered an old "Republic" battleship and are looking for the player character in "Star Wars: Knights of the Old Republic 2: The Sith Lords", as opposed to playing it safe and risking the cruiser destroying the Ebon Hawk in the asteroid field]

This OP definitely looks like it came from someone who watches their "Shark Tank" and "Dragon's Den" shows! Am also a "fan" of the shows, at least, the concept and some of the products and services featured on them over the decades, just not all the "Sharks" or "Dragons" and their behavior, sometimes. MarkCuban is smart, but also an idiot at-times and with the Democrips and insulted Bitcoin/crypto fans and called them "freaks" and LoriGrenier and ArleneDickinson are just disgusting. /tangent

Anyways, this user has to cut this response short, as, just while typing this, this user was summoned to be somewhere and has to go for now.

Liked the "shame towards the past is an idicator of progress" post, because few realize that "shame" is as much of a "gift" as it can be construed as anything else, and those shameless people are slow to, if at all capable of, learning and growing and establishing and strengthening investor confidence, thus, contributing to irrational and self-destructive behavior that sends shock-waves and causes an "equal and opposite reaction", per the scientific law. Thus, the Left/State who CLAIM to be "pro-science" are NOT, in actuality, pro-science. In some cases, the religious nutjobs are more scientifically-sound than these individuals! Later!

EDIT: Am back.

Addendum 1: None of these professions listed above interest this user. Wanna be a prowrestler, football player, martial-arts fighter, real news journalist/manager/business-owner, crypto-investor/miner, bettor, private investigator/bodyguard, adventurer/explorer, the final president in U.S. history before anarchy, helping usher in "AnCapistan" from the inside, pro-gamer, actor/writer/director, and agorist/expatriate/permanent-traveler, perhaps dabble in farming/cooking, among maybe a few other things.

Notice how some of the top-earning (and least-earning) professions on this list seem to contain a large amount of (perhaps almost as a prerequisite) born-psychopaths and/or made-sociopaths and/or atheists and/or pusher-or-likely-consumer of Big Pharma drugs, but not so much those in the middle? (Surgeons/psychiatrists/pilots/truckers/pigs/cashiers/workers) The 50-25%/25-10% bracket seems like the "sweet spot" in avoiding the most vices, whilst reaping the most rewards. It's a liveable wage, yet without the microscopic focus of society and less idle time for "the-devil's-playground". "Middle America"/the middle-class is also, coincidentally, the target of the socialists/communists and corporatocracy who wants to homogenize their captive audiences, thus, make money despite themselves ("tell" people what they want, when, in fact, and in contrast to, "the customer always being right").

Taxation is theft!

Addendum 2: It goes hand-in-hand with politics, a.k.a. "poly-ticks". It's what H.L.Mencken wrote about: an "advance auction sale of stolen goods" for popularity contests!

It's like "Beowulf" and other vikings (or "Mandalorians"), sitting around a campfire, telling tales of their "victories" in order to become the next "Mandalore"/leader of the tribe, to attempt to satiate their insecurities! Whomever can round up enough druggies and put them behind bars, wins, even if "Poppy"Bush has to entrap one out of thin air just to go on TV and say there was cocaine across the street from the White House as an excuse to "go to war" (everything the State has, it stole, after all), straight out of "Emperor Palpatine's playbook".

All "politics" is is the impressment of "Dark Triad Psychology" upon the otherwise free market!

All for now. Thanks for posting and reading (if one made it this far, that is; yes, this user can be quite loquacious at times). Peace, Luv, Logic, Truth, and Anarchy (a.k.a. anarcho-capitalism, a.k.a. the logical conclusion of libertarianism, a.k.a. voluntar(y)ism, a.k.a. that which is underpinned by Austrian/Misesian Economics, the one, TRUE school of Economic thought, being that Marxism, Fabian Socialism, Keynesianism, distributism, and yes, even MiltonFriedman-backed, classically-liberal, Chicago/UCLA-School "laissez-faire" economics go too far, make no sense, and, ultimately, are self-defeating in-Nature)!

P.S.

Is the author of this piece/substack "FilthyHeretic" from "BackAlley Productions" with "EsoTheFree/EsotericEntity", or is the turtle character just a coincidence?